What is Tax Relief and how can I qualify?

Tax relief is simply put an IRS or IRS programs put into place years ago to allow taxpayers an opportunity to settle their debt for often times a fraction of what is owed. Now keep in mind that the IRS doesn’t openly push these programs

to the public, but they are however available. Fortunately we here at Colonial Tax Relief are adept to and specialize in finding the best possible solutions for those who qualify.

Our knowledgeable tax professionals can help stop wage garnishments, bank levies, etc. and even walk you through the dreaded task of audits. Our main goal here at Colonial Tax Relief is to assess and reduce your tax debt for much less than was originally owed.

Don’t ignore unpaid taxes!

We often hear from our clients that the choice to completely ignore their tax debt was an option they had chosen for

far too long due to pure fear of the IRS. This is an understandable fear by the way! However the decision to ignore the IRS and/or your debt is actually the worst decision you can possibly make. By doing this you are not only risking

unpleasant collection enforcement tactics by the IRS, but also accumulating penalties, interest, and increasingly poor credit scores.

The unfortunate decision to ignore unpaid tax debt and incurring the wrath of the IRS will undoubtedly create more stress, havoc, and strife for you and your family than actually facing the situation head on and finding the most suitable resolution possible for you.

Normally when you incur debt such as mortgages, credit card, and/or business loans, you can easily find a solution such as bankruptcy which might help to relieve your debt. In the case of the IRS however tax debt processes involved in filing bankruptcy and or using other types of settlement plans are usually extremely

complicated.

If in fact you have chosen to ignore the IRS and your unpaid taxes for too long, the IRS will most definitely at some point exercise enforcement to collect on their dues. Below we have listed just some of the consequences as a direct

result there of.

- IRS may decide to seize property and or assets by way of lien.

- IRS may place levies on your bank accounts and or any money market accounts.

- IRS tax penalties and interest ( In most cases up to 25%) may also be applied to your debt.

- As a result of this you WILL pay more than the original debt that you actually owed.

- IRS will in fact at some point garnish your wages. Now when they do this they will be extracting a sizable amount out of your income each month leaving you financially depleted.

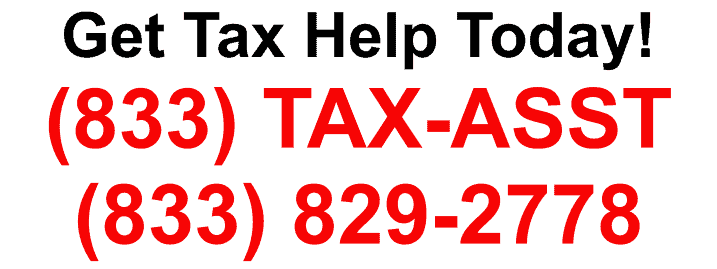

Now that you know some of the consequences of ignoring unpaid tax debt do yourself a favor and give Colonial Tax Relief a call today. We can actually help you sleep better at night. Let our knowledgeable tax professionals chart a course for success with dealing with the IRS and finding the best possible solution for you and your tax troubles.