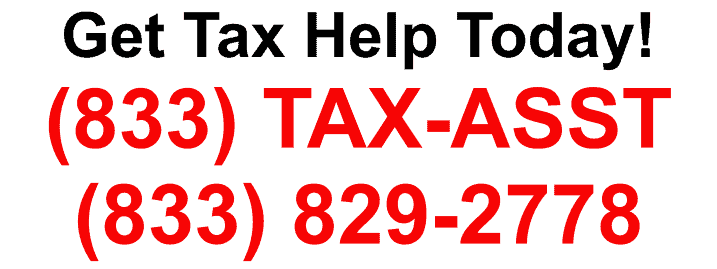

Our tax professionals are equipped to immediately begin work on your case.

Take just 10 minutes over the phone to see how Colonial Tax Relief can help you today!

Offer In Compromise (OIC)

The Offer In Compromise is a resolution program offered by the IRS which allows a qualified individual to negotiate a tax debt for less than the total amount owed.

Penalty Abatement (PENAB)

The Penalty Abatement is simply a petition that we as tax professionals here at Colonial Tax Relief would draft on behalf of you the client to have any penalties, interest, etc. accrued or assessed by the IRS lifted.

Installment Agreement (IA)

The Installment Agreement is where the client makes a monthly payment to the IRS. During this time no enforcement is taken by the IRS. There are three different types of IA’s so it is important to work with a tax professional such as the ones at Colonial Tax Relief to help qualify you for the best one that suits your needs.

Currently Non Collectable (CNC)

While under the Currently Non Collectable status the IRS generally will not try to collect an outstanding debt from you. They also will not normally levy assets and / or income at this time. They will however still assess interest and penalties to your account.

Accounting

- Financial statement preparation services

- Implementation of new accounting software packages

- Bill paying services

- Payroll and sales tax services

- Business Management

Bookkeeping

- Payroll

- Reconciliation of balance sheets

- Month end close preparation

- Accounts Payable

- Accounts Receivable

Tax Preparation

- Preparation of tax returns

- Form Preparation

- Payroll Taxes

- Tax Planning

- LLC / LLP Tax Services

- Non Profit Organization Taxes

- Business Acquisitions and Mergers

Colonial Personal and Corporate Tax

Personal and Corporate Quarterly Federal and State Tax Compliance Monitoring